Navigating the Waters: A Guide to Marine Hull Insurance for Boats in Thailand

Introduction:

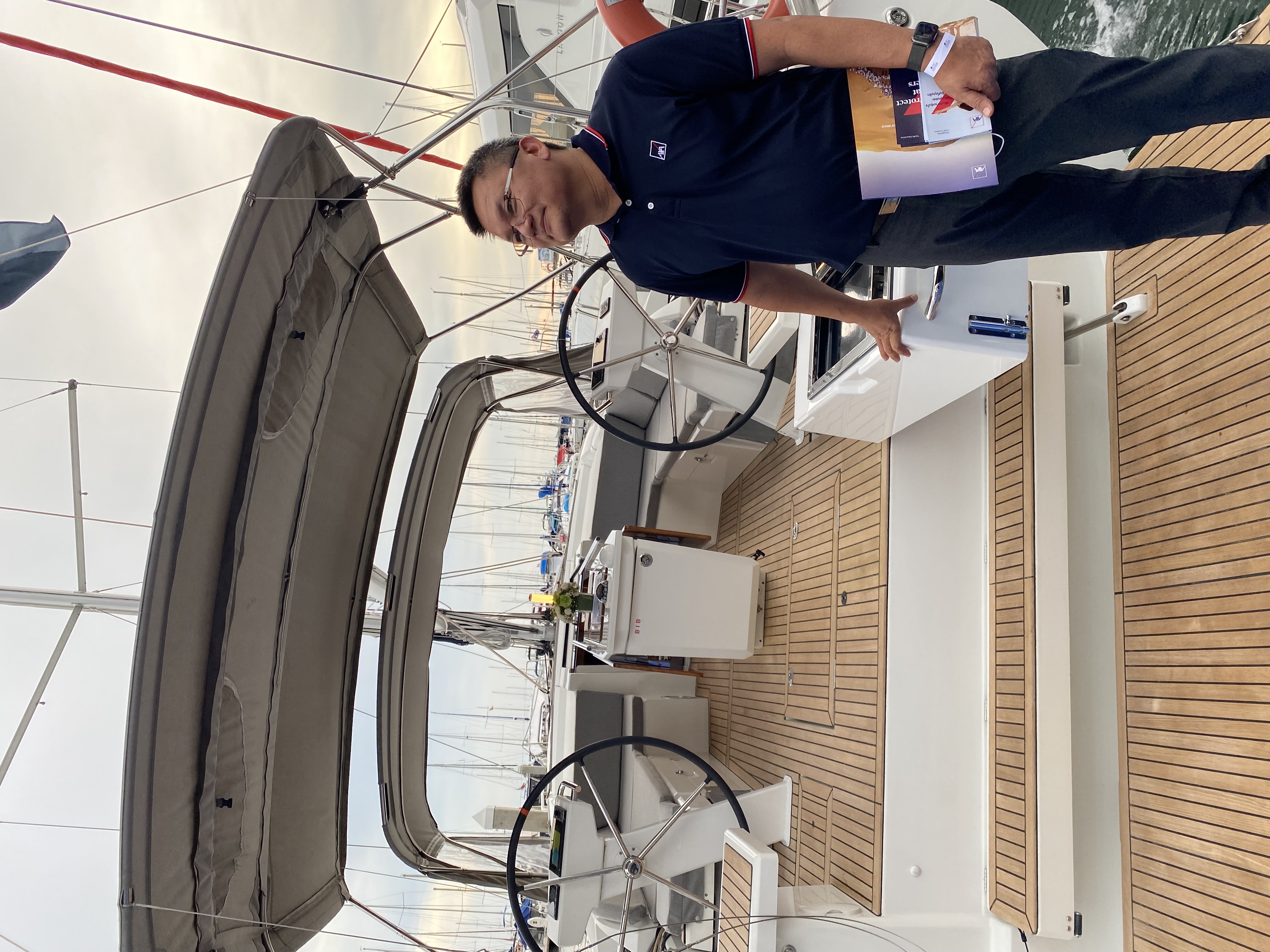

Thailand's stunning coastline, crystal-clear waters, and vibrant marine life make it a haven for boat enthusiasts and maritime adventurers alike. Whether you're a seasoned sailor or a leisure cruiser, safeguarding your vessel with marine insurance is essential to protect against unforeseen risks. In this guide, we'll explore the importance of marine hull insurance for boats in Thailand and the key considerations for securing comprehensive coverage.

Understanding Marine Hull Insurance:

Marine hull insurance is a specialized form of coverage designed to protect vessels and their cargo against a wide range of risks encountered during maritime activities. From accidental damage to theft, vandalism, and natural disasters, marine insurance provides financial protection for boat owners and operators.

In Thailand, where boating is a popular recreational activity and an integral part of the local economy, marine hull insurance plays a crucial role in ensuring the safety and security of maritime assets. Whether you own a yacht, sailboat, fishing vessel, or commercial boat, having adequate insurance coverage is essential for peace of mind on the water.

Types of Marine Hull Insurance:

There are several types of marine hull insurance policies available to boat owners in Thailand, each offering varying levels of coverage:

1. Hull Insurance: Hull insurance covers physical damage to the vessel itself, including collisions, grounding, and sinking. This type of coverage is essential for protecting the structural integrity of your boat against unexpected accidents.

2.Liability Insurance: Liability insurance provides financial protection against third-party claims for property damage or bodily injury caused by your vessel. This coverage is particularly important for boat operators, as it helps mitigate the financial consequences of accidents involving other parties.

3. Personal Accident Insurance: Personal accident insurance offers coverage for injuries sustained by the boat's occupants while on board. This can include medical expenses, disability benefits, and even death benefits in the event of a fatal accident.

4.Theft and Vandalism Insurance: Theft and vandalism insurance reimburses the owner for losses incurred due to theft, burglary, or malicious damage to the vessel or its contents. This coverage helps protect against the risk of theft in marinas or remote anchorages.

5.Storm and Natural Disaster Insurance: In regions prone to severe weather events, such as tropical storms and hurricanes, storm and natural disaster insurance provides coverage for damage caused by these events. This type of insurance is essential for safeguarding against the unpredictable forces of nature.

Choosing the Right Coverage:

When selecting a marine hull insurance policy for your boat in Thailand, it's important to assess your specific needs and risks. Factors such as the type and size of your vessel, intended usage, cruising area, and budget will influence the type and extent of coverage required.

Additionally, consider the reputation and financial stability of the insurance provider, as well as the terms and conditions of the policy, including deductibles, exclusions, and coverage limits. Working with an experienced insurance broker or agent can help you navigate the complexities of marine insurance and find a policy that meets your requirements.

Conclusion:

Marine hull insurance is a vital component of responsible boat ownership in Thailand, offering protection against a range of risks inherent to maritime activities. Whether you're exploring the Andaman Sea, cruising along the Gulf of Thailand, or navigating the country's picturesque rivers and canals, having the right insurance coverage can provide peace of mind and financial security on the water. By understanding the various types of marine hull insurance available and selecting the appropriate coverage for your vessel, you can enjoy your boating adventures in Thailand with confidence knowing that you're protected against unforeseen circumstances.