The Cost of Health Insurance in Thailand: What to Expect ?

Thailand is a popular destination for expats due to its vibrant culture, affordable cost of living, and excellent healthcare facilities. However, navigating the health insurance landscape can be a bit daunting, especially when it comes to understanding the costs involved. This blog will break down the factors affecting the cost of health insurance in Thailand and provide insights on what expats can expect to pay.

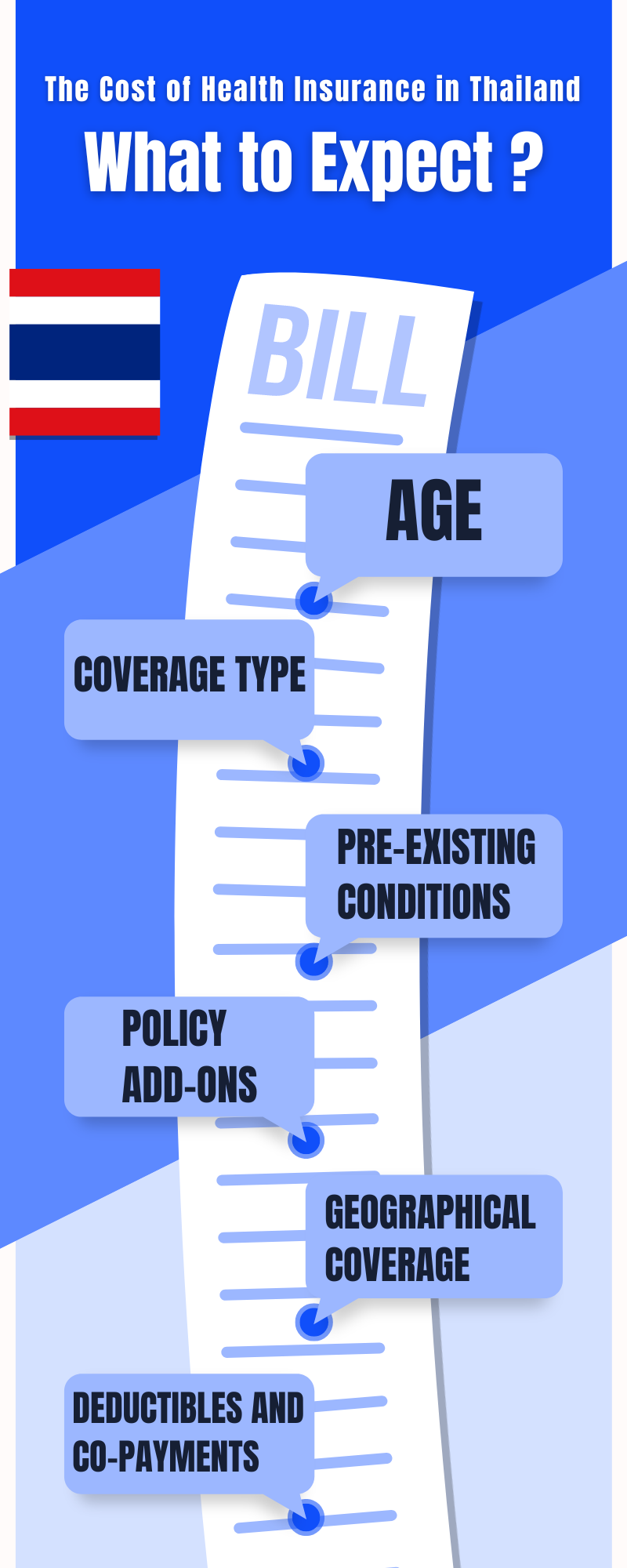

Factors Influencing Health Insurance Costs

1. Age

Premiums generally increase with age. Younger individuals can expect lower premiums, while older expats might face higher costs due to increased health risks.

2. Coverage Type

Comprehensive plans that include inpatient, outpatient, dental, and vision care are more expensive than basic plans covering only inpatient care.

3. Pre-existing Conditions

Coverage for pre-existing conditions can significantly impact premiums. Some insurers may exclude these conditions or charge higher premiums to cover them.

4. Policy Add-ons

Additional benefits such as maternity coverage, mental health services, and alternative therapies can raise the cost of premiums.

5. Geographical Coverage

International health insurance plans that offer coverage outside Thailand are generally more expensive than local plans limited to Thailand.

6. Deductibles and Co-payments

Plans with higher deductibles and co-payments tend to have lower premiums, while plans with low or no deductibles are more costly.

Average Cost Estimates

- Basic Inpatient Plans: For a healthy individual in their 30s, basic inpatient-only plans can start from around $500 to $1,000 per year.

- Comprehensive Plans: Comprehensive plans with extensive coverage can range from $1,500 to $5,000 per year, depending on the factors mentioned above.

- Family Plans: Health insurance for families can be more cost-effective per person. A family of four might expect to pay between $2,000 and $8,000 annually, depending on the coverage and ages of the family members.

Tips to Manage Health Insurance Costs

1. Compare Different Providers

Shop around and compare quotes from multiple insurance providers to find the best deal. Online comparison tools can be particularly helpful.

2. Consider Group Plans

Some employers offer group health insurance plans that are often more affordable than individual plans. Check if your employer provides this benefit.

3. Assess Your Needs

Choose a plan that matches your health needs and lifestyle. Avoid overpaying for coverage you dont need, but ensure you have adequate protection.

4. Opt for Higher Deductibles

If you are generally healthy and do not expect frequent medical visits, opting for a higher deductible plan can lower your premiums.

5. Regularly Review Your Plan

Health insurance needs can change over time. Regularly review your plan to ensure it still meets your requirements and is cost-effective.

Conclusion

The cost of health insurance in Thailand varies widely based on individual circumstances and coverage preferences. By understanding the factors that influence premiums and carefully evaluating your options, you can find a plan that provides the necessary coverage without breaking the bank. Investing time in researching and comparing different plans can lead to significant savings and peace of mind as you enjoy your life in Thailand.

Feel free to reach out to insurance brokers or consultants who specialize in expat health insurance in Thailand for personalized advice and assistance in finding the best plan for your needs.