What Does House Insurance in Thailand Actually Cover?

House insurance in Thailand can vary depending on the provider and the type of policy, but there are several common coverages that most homeowners should be aware of. Heres an overview of what a typical house insurance policy might cover:

1. Fire Damage

One of the core components of house insurance is protection against fire damage. Whether it's caused by electrical faults or accidental fires, the insurance will typically cover the cost of repairs or reconstruction of your home. 2. Natural Disasters

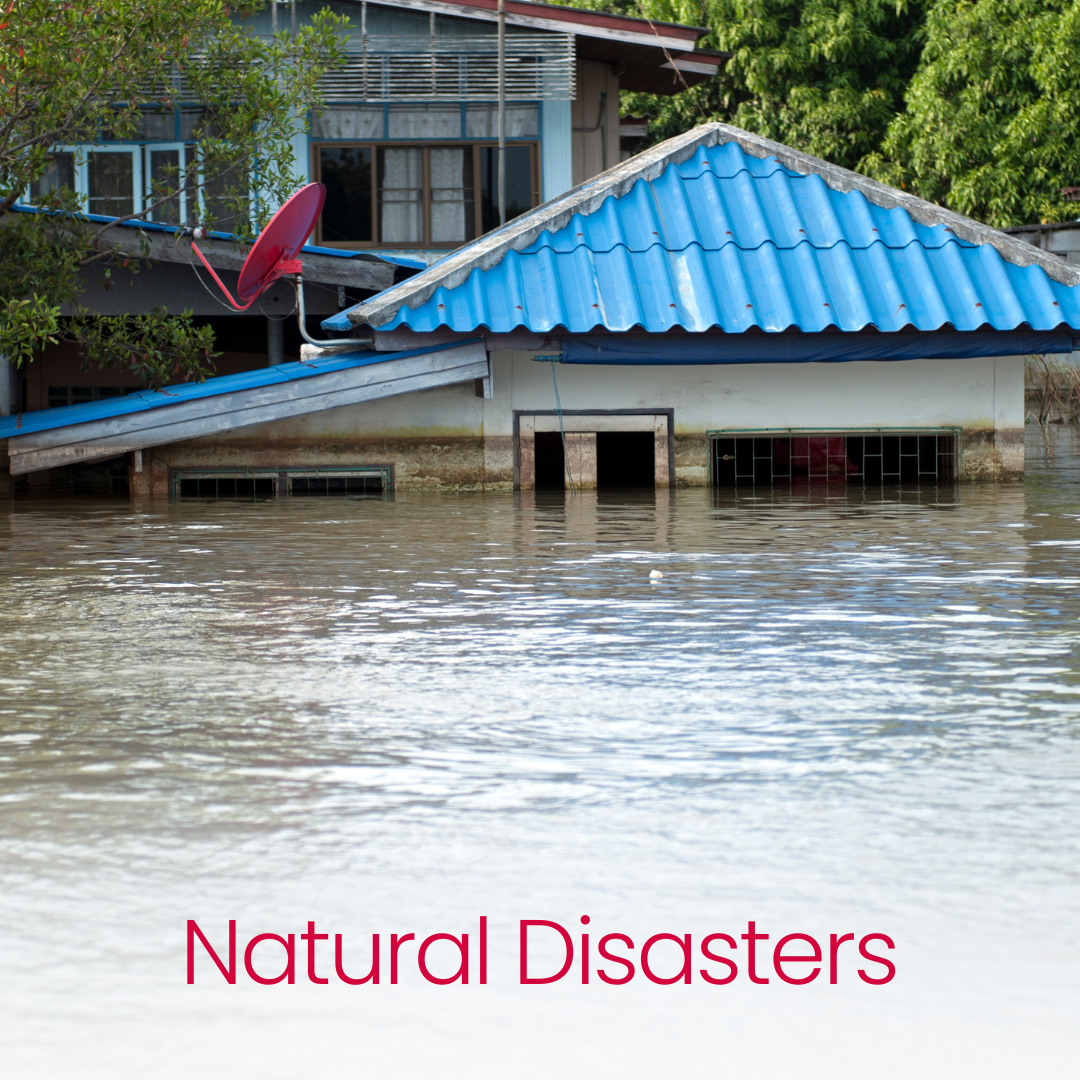

2. Natural Disasters

Thailand experiences certain natural disasters like floods, storms, and earthquakes. Many insurance policies include coverage for these events, although some policies may require additional riders for comprehensive protection, especially for floods, which are more common in certain areas.

3. Theft and Burglary

Most policies offer protection against theft or burglary. If someone breaks into your home and steals or damages your belongings, insurance can help cover the cost of replacing or repairing those items. Some policies even cover damage done during the break-in itself.

4. Third-Party Liability

House insurance in Thailand often includes liability coverage. If someone is injured on your property, whether it's a guest, a neighbor, or a contractor, this aspect of your policy helps cover medical expenses and legal fees if a lawsuit arises.

5. Water Damage

Damage caused by burst pipes, leaks, or other internal water-related issues can be covered under many house insurance policies. However, not all types of water damage are included, so its important to check for exclusions.

6. Personal Property and Contents Coverage

In addition to covering the structure of your home, many policies also include contents insurance, which protects your personal belongings like furniture, appliances, and electronics. Be sure to check if your policy covers valuables such as jewelry or art, as these might require additional coverage.

7. Accidental Damage

Some house insurance policies provide coverage for accidental damage, such as a broken window, or damage to fixtures inside your home. This is usually offered as an add-on, so you might need to request this specifically if its important to you.

8. Temporary Accommodation

If your home becomes uninhabitable due to an insured event (like a fire or flood), some policies will pay for temporary accommodation costs while repairs are being made.

Important Considerations:

- Exclusions: Always read the fine print to understand what is not covered. For example, certain natural disasters like tsunamis or landslides may not be included in a standard policy and require extra coverage.

- Policy Limits: Some coverages may have limits or caps, particularly on high-value items, so make sure you know the maximum amount your policy will pay out for specific claims.

- Premiums and Deductibles: The amount of your premium and deductible will vary depending on your coverage level and the value of your home and belongings.

By understanding what your house insurance in Thailand actually covers, you can ensure your home and belongings are fully protected against the most common risks. Its always a good idea to review your policy with your broker to tailor it to your specific needs.